(seven) Costs incurred because of the Lifetime assured for the institution of her/his individual enterprise or any commence-ups The partial withdrawals shall not be permitted if fund worth, as consequence of this withdrawal is lowered to below a hundred% in the Annualized High quality in case of Typical/Constrained High quality payment policies and at least twenty five% of The one Premium in the event of Solitary High quality payment policies. Minimal Partial withdrawal quantity permitted is INR 5,000 (in several of INR one,000). No expenses are relevant for partial withdrawals. “Annualized Quality” signifies the premium volume payable in a very calendar year excluding taxes, rider premiums and underwriting extra quality on riders, if any. Tax reward

You ought to look at every one of the elements that needs to be evaluated in the rollover selection which includes investment options, costs, fees, penalties and account protections from lawful and creditor challenges, and come up with a comparison to your present retirement account. It is best to consult together with your possess money and tax advisor before you make a rollover conclusion.

To paraphrase, Crucial Sickness reward is just not payable If your lifetime certain dies within fourteen days from the date of analysis of the lined vital disease. Waiting around Period of time for Significant disease benefit

- The absolute sum certain on Demise raises by a rate of 10% of The essential Sum confident at the conclusion of each individual 5th coverage calendar year, issue to a utmost enhance of as much as a hundred% of Essential Sum Certain.

An element within your premium goes toward supplying lifetime coverage, and The remainder is allotted to market place-linked cash. AAA – Automatic Asset Allocation As being the policy phrase progresses, the asset allocations in fairness funds lessen and debt and industry cash enhance automatically.This assures automatically balancing of money to counter current market fluctuations No Quality Allocation Costs

#Efficient sum assured is definitely the sum confident applicable to the plan year through which the insured party happens. Survival Period of time for Significant illness advantage

You could avail tax Added benefits on payment of quality underneath Segment 80C of Indian Profits Tax Act 1961* *Tax Rewards are as per Profits Tax Laws & are topic to change once in a while. Be sure to speak to your Tax advisor for details. ^The Assured Additions more (GA) would use on the cumulative premiums paid out, which is the sum from the rates paid out because of the policyholder till day, excluding the relevant taxes, underwriting extra rates and loading with the modal top quality, if any, at the end of Each and every policy year for in-drive procedures, at a simple rate.

*The fundamental sum certain is absolutely the quantity of reward chosen with the policyholder within the inception on the policy. ^The place, Annualized premium is the quality amount of money payable within a plan year, decided on through the policyholder excluding the taxes, rider rates, underwriting excess rates and loadings for modal rates, if any. #Total Rates paid out / gained means total of each of the premiums obtained, excluding any additional top quality, any rider premiums and taxes Tax Positive aspects

e) Partial withdrawals are permitted only towards the stipulated explanations:

For additional particulars on the approaches to utilise the maturity reward refer the gross sales literature. Dying profit.

SBI Life – Wise Platina Additionally is someone, non-linked, non-taking part Existence Coverage savings product. It provides fiscal independence in your potential several years by offering common confirmed income throughout the payout time period to realise your dreams. It keeps family members's economic foreseeable future secured by lifetime coverage coverage in the course of the overall coverage expression. This product or service has two profits system solution

So, if a particular investment technique just isn't Performing for yourself, you can re-Appraise and choose a unique 1 to achieve your plans. Selection of nine fund choices below Wise Choice Approach

Unforeseen costs are taken care-of by partial withdrawals from sixth plan year onwards. Avail tax Rewards* * Tax Added benefits are According to the provisions of Income Tax Regulations & are matter to alter occasionally. Please consult your Tax advisor for additional specifics.

I acknowledge SBI Lifetime's Privateness coverage and by submitting my Get hold of facts below, I override my NCPR registration and authorise SBl Everyday living and its authorised representatives to Speak to me and deliver information/conversation relating to this proposal/or perhaps the ensuing policy as a result of SMS /E-mail /Cellular phone /Letter /WhatsApp /some other electronic method of communication to my registered e mail id/cell quantity. Messages

(1) Bigger schooling of children such as lawfully adopted little one. (2) Relationship of children such as legally adopted youngster. (three) Purchase or building of a residential residence or flat inside the life certain's personal identify or in joint name with their legally wedded wife or husband. Even so, In the event the life certain now owns a residential household or flat (other than ancestral home), no withdrawal shall be permitted. (4) For procedure of crucial ailments of self or wife or husband or dependent youngsters, together with lawfully adopted child. (5) Clinical and incidental expenses arising from incapacity or incapacitation experienced by the lifestyle assured (six) Fees incurred by the life certain for skill development/reskilling or every other self-development activities.

• The policyholder has an option to make partial withdrawals from their prepare to deal with their emergencies, supplied the coverage is in pressure and write-up completion of lock-in period. Partial withdrawal : a) may be designed only after completion of lock-in period.

Scott Baio Then & Now!

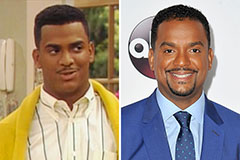

Scott Baio Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!